INVESTING IS JUST AS MUCH ART AS IT IS SCIENCE

The 5 Most Critical Aspects Of Investing

We believe in evidence. The evidence says there are 5 key factors which determine the overwhelming majority of your investment results:

1. Markets Are Efficient. The securities markets do an excellent job of valuing securities based on all available information and future expectations. As such, we do not trade stocks, bonds, or market sectors. Rather we invest in the entire marketplace of global securities (with few limitations).

2. Diversification Is Critical. By selecting specific securities or sectors of the market, you risk missing gains found in other securities or market sectors. We believe in owning ALL securities and market sectors, and the statistics verify it’s far more effective than playing the security selection game.

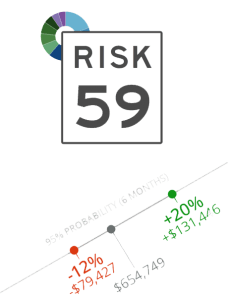

3. Returns Come With Risks. The most important investment decision we’ll make together is how much to allocate to stocks versus bonds. That single decision will determine the largest part of your investment risk and returns.

4. Portfolio Returns Are Determined By Portfolio Structure. Security selection and market timing don’t matter much. It’s the allocation plan you have in place which will determine the majority of your success or failure.

5. Rebalancing Keeps Your Plan On Track. The rebalancing process forces us to constantly “sell high” and “buy low” on your behalf. This adds incremental value to your investment returns and ultimately your financial planning results.